At Lighthouse Wealth Management, we know confidence in your investment strategy is essential. Whether you’re planning for retirement, seeking tax efficient income, or simply looking to grow your wealth, aligning your portfolio with your unique goals is key to your long-term success.

With over 20 years of combined experience, we’ve optimized a process that seamlessly integrates your entire financial picture. When you come to us for a second opinion on your investment portfolio, our team takes a comprehensive, personalized approach ensuring clarity of where you stand and how we can help guide you to your financial goals.

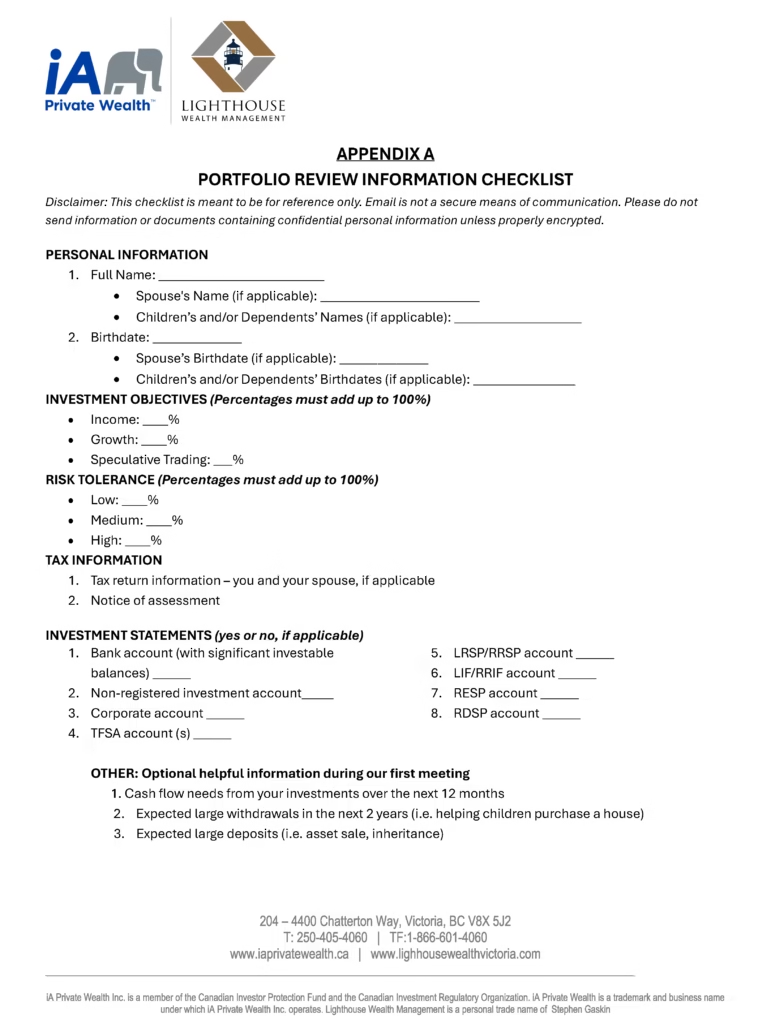

Before our first meeting, we ask prospective clients to review our checklist on Appendix A (see below) and prepare key financial details in advance – the more details you provide, the deeper our analysis and the greater value we can offer in that meeting.

From there, we’ll need about a week to thoroughly analyze your portfolio and wealth plan. During this time, we may request clarifications or additional details to ensure accuracy and value.

Lighthouse Wealth Management Analysis

Our process is built on years of industry experience, continuously refined to deliver the best possible outcomes. During our first meeting, you’ll receive a comprehensive summary of your investments by account, a consolidated view of the entire portfolio, a breakdown of your asset allocation, your geographic exposure, an analysis of your fees, a performance review, a cashflow analysis, and key insights into your wealth plan.

Summary By Account

We begin with a clear breakdown of your portfolio, based on the account type. We’ll outline the securities you hold, their sectors, their geographic exposure, their market value, the yield and any unrealized gain or loss to consider for tax planning. We’ll also assess the asset location of each security, recommending optimal placements to maximize tax efficiency, such as non-registered accounts, RRSPs, or TFSAs. If there’s an opportunity to enhance the tax efficiency of your portfolio, we’ll provide actionable insights to help you make the most of your investments.

Consolidated Portfolio View

Next, we’ll conduct a consolidated analysis of cash, fixed income, and equities to ensure your overall portfolio aligns with your risk tolerance and investment objectives. We’ll take a closer look at your asset allocation and evaluate the portfolio structure. This includes reviewing how your investments are balanced between cash, bonds, and stocks. We’ll also calculate the optimal number of equity holdings based on your account size and risk level, to ensure your portfolio is well diversified and risk is managed appropriately.

For cash, we will evaluate interest rates, issuers and CDIC coverage. For fixed income we will analyze credit rating, duration and yield. Equities will be categorized by sector and individual holdings, allowing us to identify any overlaps between accounts and analyze positions sizes of the overall portfolio. For recommended securities, we will list positions as underweight, optimal weight, or overweight.

Geographic Exposure

With the global economy constantly changing, it’s important to be mindful of where your investments are located. We will highlight global economic trends and opportunities in the market, review your portfolio’s geographic exposure, and identify risks related to currency fluctuations and foreign tax implications. We’ll also consider how tax treaties and foreign income taxation may affect your investments.

Fee Analysis

Understanding investments fees is crucial to maximizing your returns. We’ll provide a detailed breakdown of both transparent and embedded fees, such as management expense ratios (MERs), trading commissions, and advisory fees. We’ll provide insights about how these fees impact your tax situation, making sure you pay only what’s necessary and getting the best value from your investments. Embedded fees in mutual funds, such as MER’s are not tax deductible in taxable accounts, whereas advisors’ fees charged on fee-based managed accounts are tax deductible.

Cash Flow Analysis

If you depend on your investments for regular income, we’ll examine your current cash flow needs and ensure your portfolio is positioned to generate the income you require. In this section we will analyze the dividend and interest income being generated by the portfolio. We’ll analyze dividend and interest earnings, provide income projections for the year, and offer strategies to adjust income levels if needed.

Performance

We’ll assess how your portfolio’s performance against industry benchmarks, comparing various asset classes such as Canadian equities, U.S. equities, and fixed income, giving you a clear sense of how your investments measure up. We’ll also include performance reports covering various timeframes to help you see your portfolio performance over the long run.

Wealth Planning

At Lighthouse Wealth Management, we believe everyone should have a wealth plan. We believe in goals-based investing and evaluating returns in the context of risk. Advising is more than just overseeing your portfolio. Depending on the information you provide, we’ll offer insights into tax planning, retirement strategies, insurance* analysis and estate planning. Our goal is to help you develop a comprehensive, long-term plan that aligns with your life goals and values.

The Value of a Second Opinion on Your Investments

At Lighthouse Wealth Management, we believe getting a second opinion on your portfolio can be an invaluable step in ensuring your financial strategy is on track.

Our team provides an honest, straightforward portfolio analysis, offering a clear, actionable roadmap to help you reach your financial objectives with confidence. Whether you’re just beginning or are well into your financial journey, we’re here to guide you every step of the way with integrity and care.

If you’re ready for a fresh perspective on your investments, don’t hesitate to contact us. We look forward to helping you secure your financial future.

Appendix